Posted on February 26, 2012 by Ellen Brown

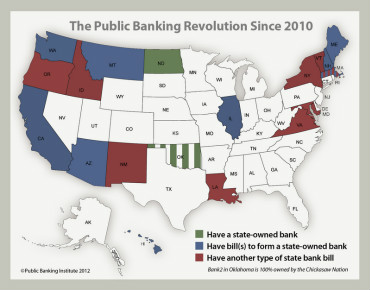

Seventeen states have now introduced bills for state-owned banks, and others are in the works. Hawaii’s innovative state bank bill addresses the foreclosure mess. County-owned banks are being proposed that would tackle the housing crisis by exercising the right of eminent domain on abandoned and foreclosed properties. Arizona has a bill that would do this for homeowners who are current in their payments but underwater, allowing them to refinance at fair market value. Continue reading →

Filed under: Ellen Brown Articles/Commentary | 14 Comments »

Posted on February 20, 2012 by Ellen Brown

In an article titled “Still No End to ‘Too Big to Fail,’” William Greider wrote in The Nation on February 15th:

Financial market cynics have assumed all along that Dodd-Frank did not end “too big to fail” but instead created a charmed circle of protected banks labeled “systemically important” that will not be allowed to fail, no matter how badly they behave.

That may be, but there is one bit of bad behavior that Uncle Sam himself does not have the funds to underwrite: the $32 trillion market in credit default swaps (CDS). Thirty-two trillion dollars is more than twice the U.S. GDP and more than twice the national debt. Continue reading →

Filed under: Ellen Brown Articles/Commentary | 60 Comments »

Posted on February 16, 2012 by Ellen Brown

A warm invitation is extended to our first annual Public Banking Institute Conference at the Friends Center in Philadelphia, April 27th-28th. More information is here.

Filed under: Networking | Leave a comment »

Posted on February 4, 2012 by Ellen Brown

A foreclosure settlement between five major banks guilty of “robo-signing” and the attorneys general of the 50 states is pending for Monday, February 6th; but it is still not clear if all the AGs will sign. California was to get over half of the $25 billion in settlement money, and California AG Kamala Harris has withstood pressure to settle.

That is good. She and the other AGs should not sign until a thorough investigation has been conducted. The evidence to date suggests that “robo-signing” was not a mere technical default or sloppy business practice but was part and parcel of a much larger fraud, the fraud that brought down the whole economy in 2008. It is not just distressed homeowners but the entire economy that has paid the price, resulting in massive unemployment and a shrunken tax base, throwing state and local governments into insolvency and forcing austerity measures and cutbacks in government services across the nation. Continue reading →

Filed under: Ellen Brown Articles/Commentary | 23 Comments »

Move Our Money: New State Bank Bills Address Credit and Housing Crises

Seventeen states have now introduced bills for state-owned banks, and others are in the works. Hawaii’s innovative state bank bill addresses the foreclosure mess. County-owned banks are being proposed that would tackle the housing crisis by exercising the right of eminent domain on abandoned and foreclosed properties. Arizona has a bill that would do this for homeowners who are current in their payments but underwater, allowing them to refinance at fair market value. Continue reading →

Filed under: Ellen Brown Articles/Commentary | 14 Comments »