A Jan. 17 article on Quartz Markets by Catherine Baab reports that JPMorgan Chase, Goldman Sachs, Wells Fargo, Citigroup and Bank of America returned nearly all of their 2025 profits to shareholders. Goldman Sachs returned $16.78 billion on $17.18 billion in earnings, meaning 97.7% of its earnings went to shareholders. Wells Fargo, Citigroup, JPMorgan, and Bank of America collectively returned tens of billions more. Across the six largest banks, roughly $100 billion flowed to shareholders in a single year.

They are currently paid 3.65% on their reserves (substantially more than the banks pay on their customers’ deposits), simply for holding them in reserve accounts rather than using them to capitalize new loans. Tens of billions of dollars that were once remitted to the Treasury now land on bank balance sheets with no public benefit attached.

We subsidize the banks’ safety, underwrite their liquidity, and reward them for sitting on assets, without requiring them to invest in communities, build public wealth, or serve any public purpose. It all seems pretty outrageous; but as it turns out, the banks are doing what U.S. corporate law requires them to do. If they don’t follow the “shareholder primacy rule,” they could actually be sued by their shareholders.

Continue readingFiled under: Ellen Brown Articles/Commentary | Tagged: bank buybacks, Bank of North Dakota, community banks, corporate governance, economic inequality, Ellen Brown, financialization, JS, NATIONAL INFRASTRUCTURE BANK, public banking, shareholder primacy, Wall Street extraction | 5 Comments »

Regime Change at the Fed: From Big Bank Bailouts to Local Productivity

Image by ScheerPost.

On January 30, when former Federal Reserve board member Kevin Warsh was nominated by President Trump as the central bank’s next chair, markets sold off and gold and silver plunged. Investors were positioned for a “dove,” someone inclined to cut rates aggressively and keep money loose; and Warsh has a long-standing reputation as a “hawk.”

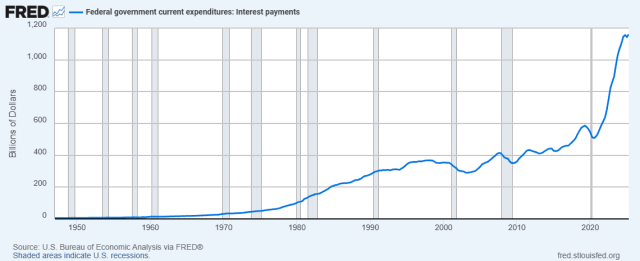

So wrote Michael Nicoletos in an article titled “Everyone Is Focusing on the Wrong Thing.” But Nicoletos and some other commentators are seeing something else on the horizon – a rebalancing of the banking system through an overhaul of the Federal Reserve itself. In recent months, noted Nicoletos, Warsh has argued that the central bank’s “bloated balance sheet” has made borrowing “too easy” for Wall Street, while leaving “credit on Main Street too tight.” That contrast — abundant liquidity for the largest financial institutions, scarcity for the communities that actually generate economic activity — is a structural flaw that has unbalanced the American economy.

Continue reading →Filed under: Ellen Brown Articles/Commentary | Tagged: Bank of North Dakota, community banks, economics, economy, Federal Reserve, FINANCE, Financial Regulation, Kevin Warsh, money, NATIONAL INFRASTRUCTURE BANK, politics, Public Banking, quantitative easing, Scott Bessent | 3 Comments »