Reading the tea leaves for the 2024 economy is challenging. On January 5th, Treasury Secretary Janet Yellen said we have achieved a “soft landing,” with wages rising faster than prices in 2023. But critics are questioning the official figures, and prices are still high. Surveys show that consumers remain apprehensive.

There are other concerns. On Dec. 24, 2023, Catherine Herridge, a senior investigative correspondent for CBS News covering national security and intelligence, said on “Face the Nation,” “I just feel a lot of concern that 2024 may be the year of a black swan event. This is a national security event with high impact that’s very hard to predict.”

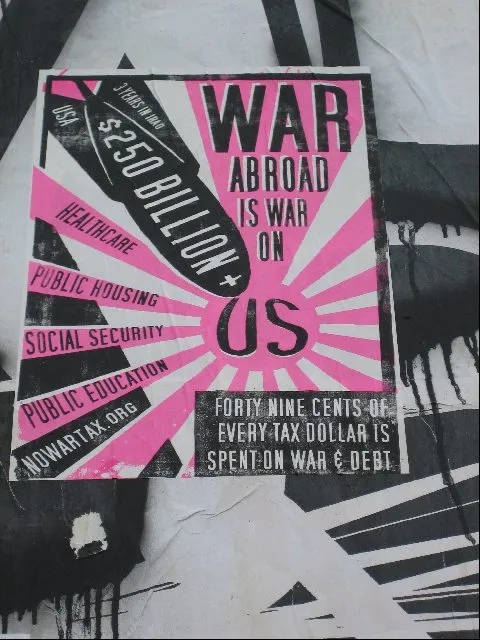

What sort of event she didn’t say, but speculations have included a major cyberattack; a banking crisis due to a wave of defaults from high interest rates, particularly in commercial real estate; an oil embargo due to war; or a civil war. Any major black swan could prick the massive derivatives bubble, which the Bank for International Settlements put at over one quadrillion (1,000 trillion) dollars as far back as 2008. With global GDP at only $100 trillion, there is not enough money in the world to satisfy all these derivative claims. A derivative crisis helped trigger the 2008 banking collapse, and that could happen again.

The dangers of derivatives have been known for decades. Warren Buffett wrote in 2002 that they were “financial weapons of mass destruction.” James Rickards wrote in U.S. News & World Report in 2012 that they should be banned. Yet Congress has not acted. This article looks at the current derivative threat, and at what might motivate our politicians to defuse it.

Continue readingFiled under: Ellen Brown Articles/Commentary | Tagged: banking crisis, derivatives, economy, Ellen Brown, Great Taking, inequality | 10 Comments »

Tackling California’s Budget Crisis: Raise Taxes, Cut Programs, or Form a Bank?

In 2022, the state of California celebrated a record budget surplus of $97.5 billion. Two years later, according to the Legislative Analyst’s Office, this surplus has plummeted to a record budget deficit of $73 billion. Balancing the budget will be challenging. Unlike the federal government, the state cannot just drive up debt and roll it over year after year. The California Balanced Budget Act, passed in 2004, requires the state legislature to pass a balanced budget every year.

The usual solutions are to cut programs or raise taxes, but both approaches are facing an uphill battle. Raising taxes would require a two-thirds vote of the legislature, which would be very challenging, and worthy public programs are in danger of getting axed, including homelessness prevention and funding for low-income housing.

A third possibility might be to increase the income tax base and state income by stimulating the economy with a state-owned depository bank. The state-owned Bank of North Dakota, which has raised record profits for its state, is a stellar example. In a review of states with the healthiest budgets based on data from the PEW Charitable Trusts, U.S. News & World Report puts North Dakota at No. 1 in Budget Balancing and #1 in Short-term Fiscal Stability.

California has an Infrastructure and Development Bank, which is already capitalized and has an established track record of prudent and productive lending, but it is not a depository bank and its reach is small. Transforming it into a depository bank would be fairly uncomplicated and could substantially increase its reach.

But first a look at what happened to the state’s copious revenues.

Continue reading →Filed under: Ellen Brown Articles/Commentary | Tagged: Bank of North Dakota, banking, economy, Ellen Brown, homelessness, public banking, UNEMPLOYMENT CRISIS | Leave a comment »