Public banks in North Dakota, Germany and Switzerland have been shown to outperform their private counterparts. Under the TPP and TTIP, however, publicly-owned banks on both sides of the oceans might wind up getting sued for unfair competition because they have advantages not available to private banks.

In November 2014, the Wall Street Journal reported that the Bank of North Dakota (BND), the nation’s only state-owned bank, “is more profitable than Goldman Sachs Group Inc., has a better credit rating than J.P. Morgan Chase & Co. and hasn’t seen profit growth drop since 2003.” The article credited the shale oil boom; but as discussed earlier here, North Dakota was already reporting record profits in the spring of 2009, when every other state was in the red and the oil boom had not yet hit. The later increase in state deposits cannot explain the bank’s stellar record either.

Then what does explain it? The BND turns a tidy profit year after year because it has substantially lower costs and risks then private commercial banks. It has no exorbitantly-paid executives; pays no bonuses, fees, or commissions; has no private shareholders; and has low borrowing costs. It does not need to advertise for depositors (it has a captive deposit base in the state itself) or for borrowers (it is a wholesome wholesale bank that partners with local banks that have located borrowers). The BND also has no losses from derivative trades gone wrong. It engages in old-fashioned conservative banking and does not speculate in derivatives.

Lest there be any doubt about the greater profitability of the public banking model, however, this conclusion was confirmed in January 2015 in a report by the Savings Banks Foundation for International Cooperation (SBFIC) (the Sparkassenstiftung für internationale Kooperation), a non-profit organization founded by the the Sparkassen Finance Group (Sparkassen-Finanzgruppe) in Germany. The SBFIC was formed in 1992 to make the experience of the German Sparkassen – municipally-owned savings banks – accessible in other countries.

The Sparkassen were instituted in the late 18th century as nonprofit organizations to aid the poor. The intent was to help people with low incomes save small sums of money, and to support business start-ups. Today, about half the total assets of the German banking system are in the public sector. (Another substantial chunk is in cooperative savings banks.) Local public banks are key tools of German industrial policy, specializing in loans to the Mittelstand, the small-to-medium size businesses that are at the core of that country’s export engine. The savings banks operate a network of over 15,600 branches and offices and employ over 250,000 people, and they have a strong record of investing wisely in local businesses.

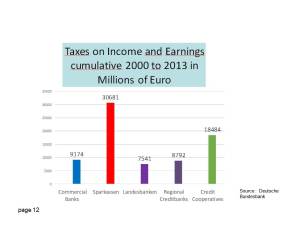

In January 2015, the SPFIC published a report drawn from Bundesbank data, showing that the Sparkassen not only have a return on capital that is several times greater than for the German private banking sector, but that they pay substantially more to local and federal governments in taxes. That makes them triply profitable: as revenue-generating assets for their government owners, as lucrative sources of taxes, and as a stable funding mechanism for small and medium-sized businesses (a funding mechanism sorely lacking in the US today). Three charts from the SBFIC report are reproduced in English below. (Sparkassen results are in orange. Private commercial banks are in light blue.)

Swiss Publicly-Owned Banks and the Swiss National Bank: Marching to a Different Drummer

The Swiss have a network of cantonal (provincially-owned) banks that are so similar to the Sparkassen banks that they were invited to join the SBFIC. The Swiss public banks, too, have been shown to be more profitable than their private counterparts. The Swiss public banking system helps explain the strength of the Swiss economy, the soundness of its banks, and their attractiveness as a safe haven for foreign investors.

The unique structure of the Swiss banking system also helps explain the surprise move by the SNB on January 15, 2015, when it lifted the cap on the Swiss franc as against the euro, anticipating the European Central Bank’s move to embark on a massive program of quantitative easing the following week. Switzerland is not a member of the EU or the Eurozone, and the Swiss National Bank (SNB) is not like other central banks. It is 55% owned by the country’s 26 cantons or provinces. The remaining investors are private. Each canton has its own publicly-owned cantonal bank, which provides credit to local small and medium-sized businesses.

In 2011, the SNB pegged the Swiss franc to the euro at 1 to 1.20; but the value of the euro steadily dropped after that, and the SNB could maintain the peg only by printing Swiss francs, diluting their value to keep up with the euro. The fear was that once the ECB started its new money printing program, the Swiss franc would have to be diluted into hyperinflation to keep up.

The SNB’s unanticipated action imposed heavy losses on speculators who were long the euro (betting it would rise), and the move evoked criticism from the European central banking community for not tipping them off beforehand. But the loyalty of the Swiss National Bank is to its cantons, cantonal banks, and individual investors, not to the big private international banks that drive central bank policies in other countries. The cantons had been complaining that they were no longer receiving the hefty 6% dividend they had been able to count on for the previous century. The SNB promised to restore the dividend in 2015, and lifting the cap was evidently felt necessary to do it.

Publicly-owned Banks and the Trans-Pacific Partnership

The SBFIC is working particularly hard these days to make information and technical help available to other countries interested in pursuing their beneficial public model, because that model has come under attack. Private international competitors are pushing for regulations that would limit the advantages of publicly-owned banks, through Basel III, the European Banking Union, and the Transatlantic Trade and Investment Partnership (TTIP).

In the US, the current threat is from the TransPacific Partnership (TPP) and its European counterpart the TTIP. President Obama, the Chamber of Commerce, and other corporate groups are pushing hard for fast track authority to pass these secret trade agreements while effectively bypassing oversight from Congress.

The agreements are being sold as promoting trade and increasing jobs, but the effect of international trade agreements on jobs was evident with NAFTA, which hurt US employment more through the competition of cheap imports than helped it with increased exports. Moreover, only five of the TPP’s twenty-nine chapters are about trade. The remaining chapters are basically about getting government off the backs of the big international corporations and protecting their profits from competition. Corporations would be authorized to sue governments that passed laws protecting their people from corporate damage, on the ground that the laws impair corporate profits. The trade agreements put corporations before governments and the people they represent.

Particularly targeted are government-owned industries, which can undercut big corporate prices; and that includes publicly-owned banks. Public banks are true non-profits that recycle earnings back into the community rather than siphoning them into offshore tax havens. Not only are the costs of public banks quite low, but they are safer for depositors; they allow public infrastructure costs to be cut in half (since the government-owned bank can keep the interest that composes 50% of infrastructure costs); and they provide a non-criminal alternative to an international banking cartel caught in a laundry list of frauds.

Despite these notable benefits, under the TPP and TTIP, publicly-owned banks might wind up getting sued for unfair competition because they have advantages not available to private banks, including the backing of their local governments. They have the backing of the government because they are the government. The government would be getting sued for operating efficiently in the best interests of its constituents.

To truly eliminate unfair competition, the giant monopolistic multinational corporations should be broken up, since they have an obvious unfair trade advantage over small farmers and small businesses. But that outcome is liable to be long in coming. In the meantime, fast track for the secretive trade agreements needs to be vigorously opposed. To find out how you can help, go to www.StopFastTrack.com or www.FlushtheTPP.org.

____________________

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt. Her latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 200+ blog articles are at EllenBrown.com.

Filed under: Ellen Brown Articles/Commentary |

Would credit unions be as good as, and safe as, Public Banks?

they don’t want us to have anything …. And what will become of the Free Market with the Implementation of this agenda ?

The call is for community to defend itself from non-governmental as well as governmental regulatory commissions, which is good as far as it goes, but more is needed. Actually community is needed. That is a word lost in our society. Community is an organization purposed to meet the existential needs of its people.

See: Agenda 21 Explained

https://www.youtube.com/watchv=9GykzQWlXJs&list=PLjH9zd48xmP8Ys9sL0zUlJ1J0gvLxF_nI

This is the more international perspective:

Agenda 21, by Lord Monckton

See: Michel Chossudovsky :

http://wn.com/michel_chossudovsky

See my essay, What is Community?, at my blog:

http://decentralizationblog.wordpress.com

Than you for the Glenn Beck video.

they don’t want us to own anything…. And what will become of the Free Market with the Implementation of this agenda ?

Reblogged this on Joseph Davis and commented:

Be sure to see Ellen Brown’s recent speech titled “The Public Bank Solution to Government Debt and Budget Shortfalls” during the January 2015 Banking on Colorado Conference in Denver, Colorado.

Reblogged this on THE ONENESS of HUMANITY and commented:

Ellen Brown writes that “Public banks provide a non-criminal alternative to an international banking cartel caught in a laundry list of frauds.” International banking cartel = laundry list of frauds. Public banking = zero fraud.

These sources narrow down to what we oppose:

Eustace Mullins:

Fox News report on Israeli spying in the U.S.

Totalitarian Control of the United States:

Reality check on the New World Order – Foster Gamble or Kimberly Gamble (part 1)

(part 2) https://www.youtube.com/watch?v=yGnsYAP30qA

Agenda 21 Explained,

Presented 11/28/2011 Copyright 2011 John Anthony:

Agenda 21, Lord Monckton international perspective:

Agenda 21: The Giant UN Eugenics Death Cult Exposed

Glenn Beck on Agenda 21:

Dan Happel, Sustainable Destruction – Exposing Agenda 21 in Rural America

Fox ‘News’ Glenn Beck outlined the Rothschild Central Bank:

http://www.youtube.com/watch?v=wvUMI7UzT1Y

Michel Chossudovsky, the Globalization of War:

http://wn.com/michel_chossudovsky

You all be well!

Reblogged this on Wobbly Warrior's Blog.

The Federal Reserve System is a department of the Bank of England, and they are Zionist. See:

Eustace Mullins:

Fox News report on Israeli spying in the U.S.

Totalitarian Control of the United States:

Reality check on the New World Order – Foster Gamble or Kimberly Gamble (part 1)

(part 2) https://www.youtube.com/watch?v=yGnsYAP30qA

Agenda 21 Explained,

Presented 11/28/2011 Copyright 2011 John Anthony

Agenda 21, Lord Monckton international perspective:

Dan Happel, Sustainable Destruction – Exposing Agenda 21 in Rural America

Fox ‘News’ Glenn Beck outlined the Rothschild Central Bank.

http://www.youtube.com/watch?v=wvUMI7UzT1Y

[…] READ MORE HERE […]

I burst out laughing aloud when I read that the ‘private’ banks could sue for unfair competition under the leaked proposed TPP rules. Not to mention the Atlantic version of same.

It should be the other way around. ‘Private’ banks are so heavily subsidized by governments that they would not survive at all without ‘bail-outs’, ‘bail-ins’, quantitative easing and outright grants organized by central banks and governments. Not only that, the private banks are so badly run, and their business models are so out of touch with reality, are so corrupt and self-serving, that these subsidies must be continuous and with no end in sight. They can only end when they have completely bankrupted the host countries and brought ruin to us all.

Obviously, since they are writing the financial rules in these two new major ‘trade’ deals, they are writing them in their favor. The kind of subsidies necessary for their continued survival will be legislated as ‘not-subsidies’, deposits of state funds from taxes will be legislated as ‘illegal’ and ‘unfair’, and that will be that. Lawmakers under their control can make any laws they please, use any weasel words they please, and their enforcers can enforce any law they choose. And their contributors can choose just who the law will be selectively applied to; anyone or any organization that does not have sufficient political power, wealth, or connections. That is, these laws will certainly not apply to the 0.1% at the top of the economic food chain, or their chosen favorites!

In response to another question above, Credit Unions are not the answer; they are only peripheral players. One reason is that they are separate, are not large enough even collectively, and cannot act together to change the big picture. They are pretty much powerless politically, and have no international (global) capacity for action, like the mega private bank cartels. And, unlike state or canton banks, they do not have the state accounts to provide the financial muscle they would need to become effective ‘players’.

Dear Ames Gilbert,

You are absolutely right. However, the solution is unavoidably radical. Public Banks that use Federal Reserve Notes slow the processes of fiscal-self destruction, and are explicitly useful for temporal, regional fiscal stability, and can buy us time for another option which is yet in its embryonic stage of development.

Sovereignty is the ground of being for the people’s independence, our birthright. But that proposition requires the development of a “production-based” economy; local production for local use. The radicalism of that proposition includes the people turning their backs on the economies of scale and the fiat money loaned by the central bank. Loaning valueless money with the intent of usury is pure wickedness. I need not elaborate.

The best option is a contrasting, mutualistic, decentralized civilization with its independent community mutual banks of “work-based” money and its reserves, appropriate industry in production-based economy, independent agriculture, confederated sovereign communities, with authentic democracy, a structured, dialogical, consensus-based community decision making process. What is needed is that complete independence from mass-centralist-society and from the criminals that dominate it.

Rest assured, that strength is forthcoming, and the drama of the former ‘civilization’ being absorbed and transformed into the subsequent civilization will have its day. Otherwise, the perpetual war for domination will most certainly be our doom. You see, those guys are really insane, thus irrational, and most assuredly necrophilic. They strive to do us in. However, they are few in numbers, and are truly weak, because they rely solely on the unstable systems of control with which they endeavor to fetter us. That is their supreme stupidity and their “Achilles’ heel.” That type of dependence …provides the people with the chance they need to organize independently and successfully, as touched on above. And, yes, the people will prevail.

You be well.

Yours, Reed Kinney

Dear Ames Gilbert,

You are absolutely right. However, the solution is unavoidably radical. Public Banks that use Federal Reserve Notes slow the processes of fiscal-self destruction, and are explicitly useful for temporal, regional fiscal stability, and can buy us time for another option which is yet in its embryonic stage of development.

Sovereignty is the ground of being for the people’s independence, our birthright. But that proposition requires the development of a “production-based” economy; local production for local use. The radicalism of that proposition includes the people turning their backs on the economies of scale and the fiat money loaned by the central bank. Loaning valueless money with the intent of usury is pure wickedness. I need not elaborate.

The best option is a contrasting, mutualistic, decentralized civilization with its independent community mutual banks of “work-based” money and its reserves, appropriate industry in production-based economy, independent agriculture, confederated sovereign communities, with authentic democracy, a structured, dialogical, consensus-based community decision making process. What is needed is that complete independence from mass-centralist-society and from the criminals that dominate it.

Rest assured, that strength is forthcoming, and the drama of the former ‘civilization’ being absorbed and transformed into the subsequent civilization will have its day. Otherwise, the perpetual war for domination will most certainly be our doom. You see, those guys are really insane, thus irrational, and most assuredly necrophilic. They strive to do us in.

However, they are few in numbers, and are truly weak, because they rely solely on the unstable systems of control with which they endeavor to fetter us. That is their supreme stupidity and their “Achilles’ heel.” That type of dependence …provides the people with the chance they need to organize independently and successfully, as touched on above. And, yes, the people will prevail.

You be well.

Yours, Reed Kinney

[…] Ellen Brown* thinks banks should become like public utilities, a view also taken by Black Swan author Nassim Taleb .. “Public banks in North Dakota, Germany and Switzerland have been shown to outperform their private counterparts” – she makes several points:- public banks have lower costs & risk than commercial banks- no exorbitantly-paid executives; pays no bonuses, fees, or commissions- no private shareholders; has low borrowing costs- do not need to advertise for depositors or for borrowers- no losses from derivative trades gone wrong- engages in old-fashioned conservative banking- does not speculate in derivativesBrown explains how private international companies are lobbying for regulations to limit the advantages of publicly-owned banks through the Transatlantic Trade and Investment Partnership (TTIP) & the TransPacific Partnership (TPP) .. “To truly eliminate unfair competition, the giant monopolistic multinational corporations should be broken up, since they have an obvious unfair trade advantage over small farmers and small businesses. But that outcome is liable to be long in coming. In the meantime, fast track for the secretive trade agreements needs to be vigorously opposed.”LINK HERE to the essay […]

[…] The Küle Library on Why Public Banks Outperform Private Banks: Unfair Competition or a Better Mousetrap? […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

[…] https://ellenbrown.com/2015/02/10/why-public-banks-outperform-private-banks-unfair-competition-or-a-b… […]

[…] the BND afford to make these very low interest loans and still turn a profit? The answer is that its costs are very low. It has no exorbitantly-paid executives; pays no bonuses, fees, or commissions; pays no dividends […]

[…] Why Public Banks Outperform Private Banks: Unfair Competition or a Better Mousetrap? […]

[…] Why Public Banks Outperform Private Banks: Unfair Competition or a Better Mousetrap? […]

[…] commentators credit the oil boom, but other states with oil have not fared so well. And the boom did not actually hit in North Dakota until 2010. The budget of every state but North Dakota had already slipped into the red by the spring of […]

I’m writing to find out if you either have a link to a website page on your website, or know of anywhere else that may list small banks (public, or if private, then; at least Not one of the big banks) that may offer credit cards to applicants who do Not necessarily live nearby, & thus would allow for filling out an application either on-line or through the mail, rather than going in.

Could you please let me know, via an email reply ?

Lisa Emeott, beyondwordslabelsstaging@startmail.com

Dear Ellen,

In the advent of real community in decentralized civilization any legislation that would undermine its sovereignty would be refuted. And at once, any means within convention to eliminate any such legislation, would be deployed.

Each community in decentralized civilization would have its mutual community bank. Each bank would have two departments, one for conventional money from the central bank, and one for community autonomous money.

The need for conventional money from the central bank would diminish proportional to the growing infrastructures of the production-based economy created among growing numbers of autonomous communities. The logic of the subsequent organization among mutualistic, sovereign communities is almost self-evident, so further elaboration here is not needed.

A “new mousetrap” is a contrasting civilization, and that too will come to pass.

Ellen, your important work is priceless, and most appreciated. You keep up your good work our friend.

Yours, Reed Kinney

[…] consistently reaches optimistic conclusions about publicly-owned banks. To use just one example, Ellen Brown’s 2015 compilation of research on Sparkassen is devastating to Cato’s […]

[…] consistently reaches optimistic conclusions about publicly-owned banks. To use just one example, Ellen Brown’s 2015 compilation of research on Sparkassen is devastating to Cato’s […]

[…] consistently reaches optimistic conclusions about publicly-owned banks. To use just one example, Ellen Brown’s 2015 compilation of research on Sparkassen is devastating to Cato’s […]