A central bank-financed UBI can fill the debt gap, providing a vital safety net while preventing cyclical recessions.

According to an April 6 article on CNBC.com, Spain is slated to become the first country in Europe to introduce a universal basic income (UBI) on a long-term basis. Spain’s Minister for Economic Affairs has announced plans to roll out a UBI “as soon as possible,” with the goal of providing a nationwide basic wage that supports citizens “forever.” Guy Standing, a research professor at the University of London, told CNBC that there was no prospect of a global economic revival without a universal basic income. “It’s almost a no-brainer,” he said. “We are going to have some sort of basic income system sooner or later ….”

“Where will the government find the money?” is no longer a valid objection to providing an economic safety net for the people. The government can find the money in the same place it just found more than $5 trillion for Wall Street and Corporate America: the central bank can print it. In an April 9 post commenting on the $1.77 trillion handed to Wall Street under the CARES Act, Wolf Richter observed, “If the Fed had sent that $1.77 Trillion to the 130 million households in the US, each household would have received $13,600. But no, this was helicopter money exclusively for Wall Street and for asset holders.”

“Helicopter money” – money simply issued by the central bank and injected into the economy – could be used in many ways, including building infrastructure, capitalizing a national infrastructure and development bank, providing free state university tuition, or funding Medicare, social security, or a universal basic income. In the current crisis, in which a government-mandated shutdown has left households more vulnerable than at any time since the Great Depression, a UBI seems the most direct and efficient way to get money to everyone who needs it. But critics argue that it will just trigger inflation and collapse the dollar. As gold proponent Mike Maloney complained on an April 16 podcast:

Typing extra digits into computers does not make us wealthy. If this insane theory of printing money for almost everyone on a permanent basis takes hold, the value of the dollars in your purse or pocketbook will … just continue to erode …. I just want someone to explain to me how this is going to work.

Having done quite a bit of study on that, I thought I would take on the challenge. Here is how and why a central bank-financed UBI can work without eroding the dollar.

In a Debt-Based System, the Consumer Economy Is Chronically Short of Money

First, some basics of modern money. We do not have a fixed and stable money system. We have a credit system, in which money is created and destroyed by banks every day. Money is created as a deposit when the bank makes a loan and is extinguished when the loan is repaid, as explained in detail by the Bank of England here. When fewer loans are being created than are being repaid, the money supply shrinks, a phenomenon called “debt deflation.” Deflation then triggers recession and depression. The term “helicopter money” was coined to describe the cure for that much-feared syndrome. Economist Milton Friedman said it was easy to cure a deflation: just print money and rain it down from helicopters on the people.

Our money supply is in a chronic state of deflation, due to the way money comes into existence. Banks create the principal but not the interest needed to repay their loans, so more money is always owed back than was created in the original loans. Thus debt always grows faster than the money supply, as can be seen in this chart from WorkableEconomics.com:

When the debt burden grow so large that borrowers cannot take on more, they pay down old loans without taking out new ones and the money supply shrinks or deflates.

Critics of this “debt virus” theory say the gap between debt and the money available to repay can be filled through the “velocity of money.” Debts are repaid over time, and if the payments received collectively by the lenders are spent back into the economy, they are collectively available to the debtors to pay their next monthly balances. (See a fuller explanation here.) The flaw in this argument is that money created as a loan is extinguished on repayment and is not available to be spent back into the economy. Repayment zeros out the debit by which it was created, and the money just disappears.

Another problem with the “velocity of money” argument is that lenders don’t typically spend their profits back into the consumer economy. In fact, we have two economies – the consumer/producer economy where goods and services are produced and traded, and the financialized economy where money chases “yields” without producing new goods and services. The financialized economy is essentially a parasite on the real economy, and it now contains most of the money in the system. In an unwritten policy called the “Fed put”, the central bank routinely manipulates the money supply to prop up financial markets. That means corporate owners and investors can make more and faster money in the financialized economy than by investing in workers and equipment. Bankers, investors and other “savers” put their money in stocks and bonds, hide it in offshore tax havens, send it abroad, or just keep it in cash. At the end of 2018, US corporations were sitting on $1.7 trillion in cash, and 70% of $100 bills were held overseas.

Meanwhile the producer/consumer economy is left with insufficient investment and insufficient demand. According to a July 2017 paper from the Roosevelt Institute called “What Recovery? The Case for Continued Expansionary Policy at the Fed”:

GDP remains well below both the long-run trend and the level predicted by forecasters a decade ago. In 2016, real per capita GDP was 10% below the Congressional Budget Office’s (CBO) 2006 forecast, and shows no signs of returning to the predicted level.

The report showed that the most likely explanation for this lackluster growth was inadequate demand. Wages were stagnant; and before producers would produce, they needed customers knocking on their doors.

In ancient Mesopotamia, the gap between debt and the money available to repay it was corrected with periodic debt “jubilees” – forgiveness of loans that wiped the slate clean. But today the lenders are not kings and temples. They are private bankers who don’t engage in debt forgiveness because their mandate is to maximize shareholder profits, and because by doing so they would risk insolvency themselves. But there is another way to avoid the debt gap, and that is by filling it with regular injections of new debt-free money.

How Much Money Needs to Be Injected to Stabilize the Money Supply?

The mandated shutdown from the coronavirus has exacerbated the debt crisis, but the economy was suffering from an unprecedented buildup of debt well before that. A UBI would address the gap between consumer debt and the money available to repay it; but there are equivalent gaps for business debt, federal debt, and state and municipal debt, leaving room for quite a bit of helicopter money before debt deflation would turn into inflation.

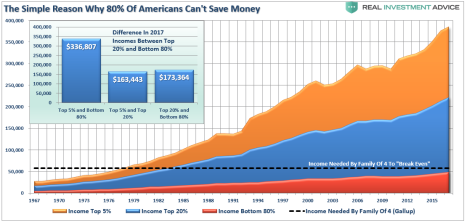

Looking just at the consumer debt gap, in 2019 80% of US households had to borrow to meet expenses. See this chart provided by Lance Roberts in an April 2019 article on Seeking Alpha:

After the 2008 financial crisis, income and debt combined were not sufficient to fill the gap. By April 2019, about one-third of student loans and car loans were defaulting or had already defaulted. The predictable result was a growing wave of personal bankruptcies, bank bankruptcies, and debt deflation.

Roberts showed in a second chart that by 2019, the gap between annual real disposable income and the cost of living was over $15,000 per person, and the annual deficit that could not be filled even by borrowing was over $3,200:

Assume, then, a national dividend dropped directly into people’s bank accounts of $1,200 per month or $14,200 per year. This would come close to the average $15,000 needed to fill the gap between real disposable income and the cost of living. If the 80% of recipients needing to borrow to meet expenses used the money to repay their consumer debts (credit cards, student debt, medical bills, etc.), that money would void out debt and disappear. These loan repayments (or some of them) could be made mandatory and automatic. The other 20% of recipients, who don’t need to borrow to meet expenses, would not need their national dividends for that purpose either. Most would save it or invest it in non-consumer markets. And the money that was actually spent on consumer goods and services would help fill the 10% gap between real and potential GDP, allowing supply to rise with demand, keeping prices stable. The end result would be no net increase in the consumer price index.

The current economic shutdown will necessarily result in shortages, and the prices of those commodities can be expected to inflate; but it won’t be the result of “demand/pull” inflation triggered by helicopter money. It will be “cost/push” inflation from factory closures, supply disruptions, and increased business costs.

International Precedents

Critics of central bank money injections point to the notorious hyperinflations of history – in Weimar Germany, Zimbabwe, Venezuela, etc. These disasters, however, were not caused by government money-printing to stimulate the economy. According to Prof. Michael Hudson, who has studied the question extensively, “Every hyperinflation in history has been caused by foreign debt service collapsing the exchange rate. The problem almost always has resulted from wartime foreign currency strains, not domestic spending.”

For contemporary examples of governments injecting new money to fund domestic growth, we can look to China and Japan. In the last two decades, China’s M2 money supply grew from 11 trillion yuan to 194 trillion yuan, a nearly 1,800% increase. Yet the average inflation rate of its Consumer Price Index hovered between 2% and 3% during that period. The flood of money injected into the economy did not trigger an inflationary crisis because China’s GDP grew at the same fast clip, allowing supply and demand to rise together. Another factor was the Chinese propensity to save. As incomes went up, the percent of income spent on goods and services went down.

In Japan, the massive stimulus programs called “Abenomics” have been funded through bond purchases by the Japanese central bank. The Bank of Japan has now “monetized” nearly half the government’s debt, injecting new money into the economy by purchasing government bonds with yen created on the bank’s books. If the US Fed did that, it would own $12 trillion in US government bonds, over three times the $3.6 trillion in Treasury debt it holds now. Yet Japan’s inflation rate remains stubbornly below the BOJ’s 2% target. Deflation continues to be a greater concern in Japan than inflation, despite unprecedented debt monetization by its central bank.

UBI and Fears of the “Nanny State”

Wary critics warn that a UBI is the road to totalitarianism, the “cashless society,” dependence on the “nanny state,” and mandatory digital IDs. But none of those outcomes need accompany a UBI. It does not make people dependent on the government, so long as they can work. It is just supplementary income, similar to the dividends investors get from their stocks. A UBI does not make people lazy, as numerous studies have shown. To the contrary, they become more productive than without it. And a UBI does not mean cash would be eliminated. Over 90% of the money supply is already digital. UBI payments can be distributed digitally without changing the system we have.

A UBI can serve the goals both of fiscal policy, providing a vital safety net for citizens in desperate times, and of monetary policy, by stabilizing the money supply. The consumer/producer economy actually needs regular injections of helicopter money to remain sustainable, stimulate economic productivity, and avoid deflationary recessions.

_______________________________

Ellen Brown is an attorney, chair of the Public Banking Institute, and author of thirteen books including Web of Debt, The Public Bank Solution, and Banking on the People: Democratizing Money in the Digital Age. She also co-hosts a radio program on PRN.FM called “It’s Our Money.” Her 300+ blog articles are posted at EllenBrown.com.

Filed under: Ellen Brown Articles/Commentary | Tagged: Debt deflation, Federal Reserve, helicopter money, Inflation, public banking, quantitative easing, UBI, Universal basic income |

hi Ellen

I presume you follow Stephanie Kelton’s efforts in promoting MMT. If one reads carefully, there are significant caveats- This is not a “free lunch”. It will be interesting to see her materials assembled in her forthcoming book

As one knows, Economy comes from the Greek meaning house. The economy is much more than the various forms of the monetary system.

The other critical factor, which Kelton mentions repeatedly is that this is primarily US centric with several caveats. One of these is the dependence on planetary resources. This is not a closed system like the game of Monopoly. Funding the fondest hopes of the GND could disrupt the entire “House”

Wouldn’t a Universal Job Guarantee as advocated by Stephanie Kelton and Roger Malcolm Mitchell et al be more of a salient solution?

It makes more common sense that the government give people a job and be productive if the private sector can’t provide all the jobs.

Of course, as I’ve been told common sense isn’t common. lol

Didn’t FDR have jobs with the WPA and FRA and other projects?

There are buildings, bridges and the like all over the United States that were built during the depression.

Regardless, lets get gong!

No, it wouldn’t. Full employment is archaic. We do not need everyone working in the formal economy and especially not at the beck and call of government policy makers who will have them, most likely, building pyramids or the equivalent. With advances in technology (50% of existing American jobs will be automated within the next 15 years anyway) we need to be giving people more leisure. A National Dividend, financed through the creation of debt-free credit, and advocated for decades by CH Douglas and the Social Credit movement, would allow for increasing leisure, freedom and independence to become a reality. It would also massively reduce pollution and resource consumption as witless, useless, redundant, and destructive ‘jobs’ are eliminated.

i’ll go for that…It seems however, that everyone is working all the time now without any leisure t’all.

My thought is that computerization and internet has made working something constant. Just look on the mass transit systems in the morning. People are on their cell phone. I would imagine most are doing or preparing for work while going to work.

I would like to make another comment am i right or did Keynes say, “there is always work to be done”

Wow, Ellen! You’re best work yet (as I keep seeing’ and sayin’). I’ll share with ~2,000 Advanced Placement Econ teachers perhaps now waking up 🙂

Unlike debt repayments, interest payments do NOT extinguish money. The former reduces assets and liabilities, the latter increases assets and retained earnings. Of course the retained earnings must be spent in order for the money to remain in circulation, either via reinvestment, dividends or even stock buy-backs. Alternatively they could be kept as bank capital, allowing up to 10x more loans and consequent money creation. In short, while interest payments can cause debt deflation by reducing the flow of funds into the real economy, they are not the immediate reason why the growth in debt has been outpacing the growth in the money supply.

Your arguments about a modest UBI not causing inflation in such an overleveraged situation are much more convincing, and this article would’ve been more persuasive if you’d limited it to that.

Won’t work. The difference between theory and reality are always worlds apart. Being selective on ‘research’ that suits your argument is disingenuous. Many people, especially those in low income jobs, would take the money and quit. They’ll probably spend their days playing computer games and getting high. There’ll be no incentive to work for the majority (most people hate work). You will get inflation as companies will simply raise prices due to all the money printing, that’s an inevitability. Finally UBI has been tried in several places and stopped as it doesn’t work.

I do not agree that people are basically lazy. I believe that people want to be productive. Productivity makes us happy,. However, if the job is a rote job and has no satisfaction. Then you are right! People will not work because the job is …Let us use an amusing analogy…Lucy Arnaz in the chocolate factory. LOL

The satisfaction of a “rote job” is that you are supporting yourself with dignity and putting food on the table. I don’t know your definition of “rote job” but few, I think, are the jobs that one can’t take some satisfaction in doing well.

The’people won’t work’ argument is the opposite of what happens in the UK because benefits are means tested – on low incomes you lose them as fast as you earn. I assume the USA does have some sort of poverty relief. http://www.clivelord.wordpress.com

Just to add to what I’ve previously written. Any such handout will likely be conditional. You must take this microchip, for example, or agree to social credit scores. Nothing is free, there’s always a catch.

is this available in spanish?

During the Depression, FDR adopted Keynesian’s suggestion for deficit spending sold as “pump priming”: the creation of jobs would be instant, but the attendant inflation not perceived until later. This time the printing presses are out in the open- whatever beneficial effect will be short-lived and inflationary.

Keynes also said when unemployment was skyrocketing and other economists were suggesting the inflation problem, ” In the long run we are all dead.”

No it won’t if balanced by taxes, mainly redistributive.

But what terrifies me in this otherwise apparently sensible article is its failure to notice economic growth threatening to trash the ecosphere.

http://www.clivelord.wordpress.com

[…] Continue Reading / Web of Debt >>> […]

Great piece thanks. You might like ‘The Case for Basic Income’ at http://www.ubi.org and my book ‘Basic Income and Sovereign Money’ at http://www.palgrave.com/gb/book/9783030367473

I like the jobs approach, if you take UBI or any other government assistance outside of SS retirement (for which you paid), then one should be automatically enrolled in govt job or work crews at least a weekend or two per month. Along with the best infrastructure, we should also have the cleanest country with weekend trash cleanup crews. Tear down the blighted buildings and areas, restore and clean up all cities. Start with Baltimore and all the big cities and move out from there.

[…] Ellen Brown Writer, Dandelion Salad The Web of Debt Blog, Apr. 19, 2020 April 20, […]

The notion the UBI will not come with conditions is simply naive. The fact that it’s being offered now in the midst of the current so-called Covid-19 “pandemic” isn’t a coincidence. Once the vast majority of the folks put out of work by the lockdown become dependent on the government handout (and yes, most will eschew working as long as the handout is available, especially if the Democrats get their way and it’s increased to $2k/month) certainly, in order to continue getting it one will be required to submit to the vaccine presently being developed, which will contain some kind of tracking/control device.

I understand the sentiment but I don’t think UBI is either essential nor will it work long term. Firstly, if every person got $13,000 the results would be hugely inflationary. While some money would be used to pay off debt, a lot would be spent. Considering how little prices have dropped during the current deflationary environment, I can only imagine how much prices would rise. And thus begins the inevitable print-inflation-print some more-to infinity cycle that ends in hyperinflation. Hyperinflation is simply deflation with the monetary hole filled in with printed money. It’s not “either deflation or hyperinflation — choose your camp”. Instead, the two go together. If the system is in a constant state of deflation, the Fed’s balance sheet sure isn’t! The deflationists simply don’t think through the end result of deflation far enough to understand that hyperinflation or something similar is inevitable.

So UBI may be a short term bandaid to the wealth inequality issue but it won’t work long term — the resulting inflation will mean that the monthly payments have to be constantly adjusted upwards to maintain real world purchasing power. The question remains valid — who will pay for it? Certainly the elites won’t be. And that leaves everybody else. Well if everybody else is broke then the UBI payments the broke masses are funding for the rest of the broke masses, will reflect that and will inevitably be inflated away into irrelevance. The reason the money Wall Street printed up and gave to itself wasn’t hugely inflationary is because it wasn’t spent.

And secondly, the current financial system isn’t going to be around much longer anyways.

Again, I understand the sentiment but I think this is missing the point — the problem stems from one thing only – a gross inequity between assets owned by the elites, and everyone else.

A much simpler way to help out the middle class would be to immediately nullify all debt so that no one owes a mortgage anymore. Therefore they won’t need to go out to work 40 hours a week to make ends meet or pay their mortgage. They can sit at home and work 10 hours a week to pay for food and other basics. 10 hours a week is around what the work week should be for everyone right now with the level of automation taking jobs away but allowing an equivalent amount of goods and services to be produced as 40 years ago.

Ultimately the only thing that will solve this is a more equitable ownership of assets. And that will only be achieved via a properly instituted wealth tax targeting the elites. Since the elites are the ones currently calling the shots the chances of this happening is basically zero.

Giving people a few dollars a month to string them along in poverty isn’t going to close the wealth inequality gap.

American workers gift the central banks with 4 Trillion dollars a year from income taxes on labor. The central bankers then take that gift from workers and redistribute to investors. Might we want to consider having a labor committee of the whole take over that 4 trillion dollars gift to the central banks and issue our money ourselves? Might we not then easily finance an existence stipend with something in it for everyone?

I agree with you! The real people on the dole are the one per cent and those who are lackeys to the one per cent. There is a book out (although I haven’t read the book) that says it all. “The best way to rob a bank is to own one.” This argument goes back all the way to Lincoln and even the Middle Ages. In the 1890’s it was the gold bugs vs the greenbacks. We haven’t and will not as long as we continue to believe in the system as it is, collectively. We all need to think outside the box. So to those who do not believe that the system needs changed or that the system can’t change because of human frailty. Can anything be done to get us out of the economic problems that are now being exacerbated by the virus crisis?

[…] Ellen Brown Web of Debt […]

“Merely the dole” is a snarky and condescending reference to an investment of time & effort on the part of those who work for a living. Why is this investment not worth paying dividends whereas an investment of capital which is often inherited and unearned in the first place demands a return? Demands, mind you, loudly, belligerently! Labor is capital, more valuable than a moldy stash of dollars! If you read Ellen’s presentation you will understand why inflation is not a problem. Those “investors” who virtue signal their concern about inflation are blithely unaware of the devaluation effect their gambling actively has on the dollar. This devaluation, paying the money-for-nothing crowd a return on their unearned dollars, is the real cause of inflation in our day. Investment today in this financialized sham market is more than ever parasitism.

Excellent analysis and very well said. More plainly put, the rich are parasites and should be done away with. Parasitism should be done away with. It doesn’t work and it is not fair.

You might enjoy “Labor and Other Capital” by Edward Kellogg 1849. Olde timey economists had better sense than most of the modern variety.

Lets not confuse a UBI which is merely the dole with less paperwork and a national dividend designed to bridge prices with net income.

The UBI will be raised via taxes and will therefore simply raise prices .

Please have a look at the literature. The Alaska PDF didn’t raise prices. It was (still is) funded from oil revenues. Nor would it if it was redistribubutive, simply shifting spending power. I am not a socialist. I would happily leave the rich richer than the rest, just not quite as rich as they are.

http://www.clivelord.wordpress.com

Dear Ellen Brown; Are you a Modern Monetary Theory MMT supporter like Stephanie Kelton and Randall Wray ? Joel ThorntonTallahassee

[…] A Universal Basic Income Is Essential and Will Work […]

[…] Questo articolo è stato originariamente pubblicato sul sito del blog dell’autore, The Web of Debt Blog . […]

UBI, as a topic, arriving in a context of “universal vaccination” with quantum dots tattoos is not a coincidence. Studying the benefits of UBI without considering the final goals of the globalist agenda serves perfectly the globalist agenda.

This article makes sense within its own terms of reference, but it terrifies me because it pays no attention to the threat to the entire ecosphere caused by economic growth. I have been pushing for a basic income for over 40 years, but only if tied to an ecological mind set – and eco-taxes.

http://www.clivelord.wordpress.com

[…] Go to Original – ellenbrown.com […]

[…] Go to Original – ellenbrown.com […]

[…] Republished from EllenBrown.com […]

[…] 23) A Universal Basic Income Is Essential and Will Work https://ellenbrown.com/2020/04/19/a-universal-basic-income-is-essential-and-will-work/ […]

Before the savage Europeans destroyed the New World environment, killing the wildlife, cutting the forests, the usual mayhem perpetrated by white colonizers in the name of god and progress, the native population enjoyed what one might call a UBI. Nature was the central bank. Hungry? Go hunt yourself a deer or a buffalo. It’s not a handout from the Great Mother to spoil her children. You have to develop some skills. But she’s there for you giving you what you need. And if you happen to be a fuck up or disabled in other ways, you can stop in at any teepee and get a meal. You won’t go hungry. The tribe has a safety net. And your life will not be nasty, brutish, and short. If it weren’t for the aborigines and their generous advice about making a livelihood from the natural UBI, the Europeans would have perished of their own incompetence.

And so, here we are today in our techno cocoon trying to imagine ways we can survive our own mayhem and incompetence. Let’s have a UBI, let’s all get together and love one another right now! That’s what a UBI is, a substitute for our own original, bountiful Gaia. She’s going to love us all. It might seem like a handout, but it will actually be some tougher love than it seems at first glance. All you can be on $1200/month is white trash!

[…] A Universal Basic Income is Essential and Will Work/ Ellen Brown Velshi: Universal basic income is the solution to job loss Entering the Mainstream: UBI/ Institute for the Future of Work […]

[…] #1: Put real money into the real economy with monthly payments of at least $1,200 to all US adults, for as long as needed, funded through the Federal Reserve. The same money tree that Congress and the Fed just used to fund a $5 trillion bailout for Wall Street and Corporate America can be used to deliver monthly dividends to the public. The Fed has now agreed to buy Treasury debt via quantitative easing to whatever extent is needed. Why these monthly payments will not result in hyperinflation is explained here. […]

In order for a guaranteed income regime to ensure middle class affluence for a consumer economy is to model it like the NBA players contract. A significant portion greater than 50% of GDP must be distributed equally among the bottom 80% of income earners. Otherwise the elites and bosses will only distribute enough to meet a minimum poverty level and make the entire bottom 80% of society paupers.

Never did get to discuss implementation with Andrew Yang, but here’s some thoughts. Change the financial system to get rid of the core problem of the wealth gap. End the Fed, which is the 1% money machine. Implement true public banking ( Not the Bank of North Dakota model!! This is not public banking ), Something like the the model proposed in HR2990 from the Kucinich presidential campaign (2011). AND, eliminate the financialization that has created the wealth gap by implementing strong usury laws.(Most of the new “financial products” Allan Greenspan loved are no more than usury arbitrage, ie, unproductive and parasitical ). Without deep structural change, what we have in a UBI is a handout from the billionaires. No Handouts! Without deep structural change, the UBI will not work!