First posted on ScheerPost.

“Rather than collecting taxes from the wealthy,” wrote the New York Times Editorial Board in a July 7 opinion piece, “the government is paying the wealthy to borrow their money.”

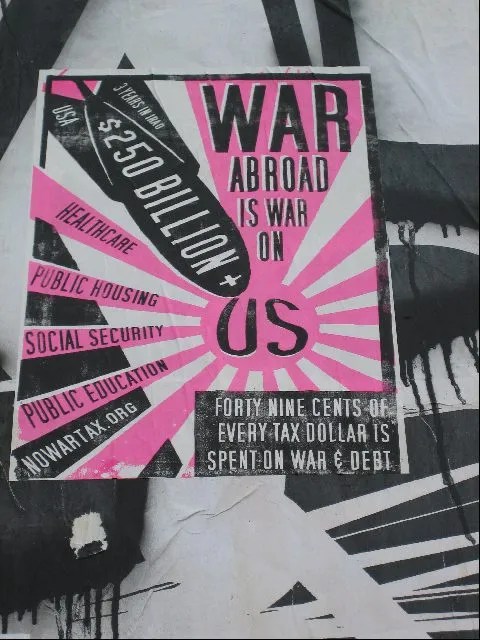

Titled “America Is Living on Borrowed Money,” the editorial observes that over the next decade, according to the Congressional Budget Office (CBO), annual federal budget deficits will average around $2 trillion per year. By 2029, just the interest on the debt is projected to exceed the national defense budget, which currently eats up over half of the federal discretionary budget. In 2029, net interest on the debt is projected to total $1.07 trillion, while defense spending is projected at $1.04 trillion. By 2033, says the CBO, interest payments will reach a sum equal to 3.6 percent of the nation’s economic output.

Continue readingFiled under: Ellen Brown Articles/Commentary | Tagged: budget ceiling, economy, Ellen Brown, Federal Reserve, Financial Transaction Tax, interest on national debt, national debt, NATIONAL INFRASTRUCTURE BANK, Pentagon budget | 8 Comments »

Why Does the Government Borrow When It Can Print?

In the first seven months of Fiscal Year (FY) 2024, net interest (payments minus income) on the federal debt reached $514 billion, exceeding spending on both national defense ($498 billion) and Medicare ($465 billion). The interest tab also exceeded all the money spent on veterans, education, and transportation combined. Spending on interest is now the second largest line item in the federal budget after Social Security and the fastest growing part of the budget, on track to reach $870 billion by the end of 2024.

According to the Congressional Budget Office, the federal budget deficit was $857 billion in the first seven months of fiscal year 2024. In effect, the government is borrowing at interest to pay the interest on its debt, compounding the debt. For the lender, it’s called “the miracle of compound interest” – interest on interest compounds exponentially. But for the debtor, it’s a curse, compounding like a cancer to the point of devouring assets while still growing the debt. As Daniel Amerman, a chartered financial analyst, writes in an article titled “Could A Compound Interest Wildfire Threaten U.S. Solvency?”:

Continue reading →Filed under: Ellen Brown Articles/Commentary | Tagged: compound interest, Federal budget, federal deficit, Financial Transaction Tax, Trillion dollar coin | 5 Comments »