This month Congress passed the GENIUS Act, an acronym for the “Guiding and Establishing National Innovation for U.S. Stablecoins of 2025.” Designed to regulate stablecoins, a category of cryptocurrency designed to maintain a stable value, the Act is highly controversial.

Critics variously argue that it anoints stablecoins as the equivalent of “programmable” central bank digital currencies (CBDCs), that it lacks strong consumer protections, and that government centralization destroys the independence of the cryptocurrency market. Proponents say the rapidly expanding stablecoin market not only provides a faster and cheaper payments system but can serve as a major funding source to help alleviate the federal debt crisis, which is poised to destroy the economy if not checked, and that the stablecoin market has gotten so large that without regulation, we may have to bail it out when it becomes a multitrillion dollar industry that is “too big to fail.”

For most people, however, the whole subject of stablecoins is a mystery, so this article will attempt to throw some light on it. It will also explore some historical use cases demonstrating how the government might incorporate stablecoins into a broader program for escaping the debt crisis altogether.

Continue readingFiled under: Ellen Brown Articles/Commentary | Tagged: bitcoin, cryptocurrencies, economics, economy, FINANCE, Genius Act, Greenbacks, money, national debt, NATIONAL INFRASTRUCTURE BANK, public banking, stablecoins | 8 Comments »

Compound Interest Is Devouring the Federal Budget: It’s Time to Take Back the Money Power

Albert Einstein is often quoted as saying that compound interest is “the most powerful force in the universe.” The quote is probably apocryphal, but it reflects a mathematical truth. Interest on earlier interest grows exponentially, outrunning the linear growth of revenue and eventually consuming everything.

That is where the United States now stands. The government does pay the interest on its debt every year, but it is having to pay it with borrowed money. The interest curve is rising exponentially, while the tax base is not.

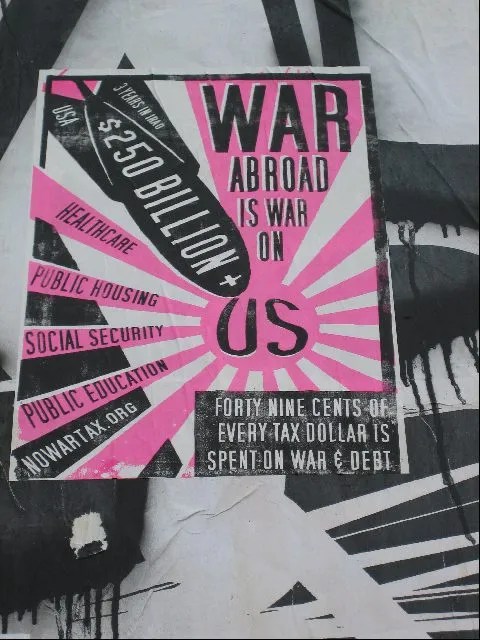

Interest is now the fastest growing line item in the entire federal budget. The government paid $970 billion in net interest in FY2025, more than the Pentagon budget and rapidly closing in on Social Security. It already exceeds spending on Medicare and national defense and is second only to Social Security. The Congressional Budget Office projects that interest will reach nearly $1.8 trillion by 2035 and will cost taxpayers $13.8 trillion over the next decade. That is roughly what Social Security will pay out over the same decade (about $1.6 trillion a year). The Social Security Trust Fund is running dry, not because there are too many seniors, but because interest payments are consuming the federal budget that should be shoring it up.

Continue reading →Filed under: Ellen Brown Articles/Commentary | Tagged: compound interest, economics, economy, Federal Reserve, FINANCE, Inflation, money, national debt, seigniorage, Trillion dollar coin | 7 Comments »